Introduction

Stock market updates play an important role in how people understand money, investing, and the economy. Every day, millions of beginners and experienced investors check stock market updates to see how markets are moving and what might happen next. These updates give quick insights into whether prices are rising, falling, or staying stable. For many people, they are the first step in making smart financial decisions.

In simple terms, stock market updates tell the story of what is happening in the market right now. They explain how major indexes are performing, which sectors are strong or weak, and what events are influencing prices. For beginners, these updates may seem confusing at first. However, with the right approach, they become easier to understand and very useful.

For intermediate investors, stock market updates help confirm trends, manage risks, and adjust strategies. They provide context, not just numbers. When markets react to economic data, company earnings, or global events, updates explain the reasons behind those moves. This helps investors avoid emotional decisions and stay focused on long-term goals.

In today’s fast-moving world, markets can change quickly. That is why following stock market updates regularly is important. Whether you invest daily, weekly, or long term, understanding these updates builds confidence. This guide explains stock market updates in simple English, step by step, so you can use them wisely and make better investment choices.

What is Stock Market Updates?

Stock market updates are short reports or summaries that explain current market activity. They show how stock prices, indexes, and sectors are performing during a specific time period. These updates may be shared daily, hourly, or even in real time.

At their core, stock market updates answer basic questions. Is the market up or down? Which stocks are gaining or losing value? What news is influencing investor behavior today? By answering these questions, updates provide a clear snapshot of the market.

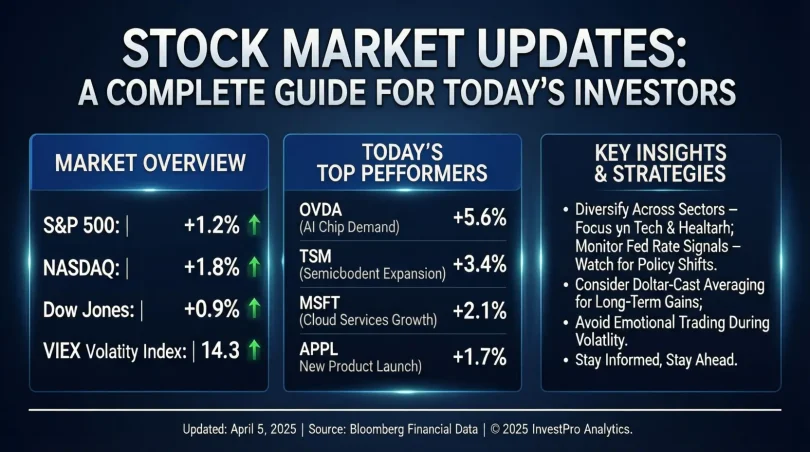

Stock market updates usually include information about major market indexes, such as overall market direction. They also highlight top-performing stocks, weak performers, and active sectors like technology, banking, or energy. In addition, they often mention economic data, interest rate changes, or global events that affect market sentiment.

For beginners, stock market updates are learning tools. They introduce common terms and patterns. For intermediate readers, they act as confirmation tools to support research and planning. In both cases, updates help investors stay informed without reading long reports.

Most importantly, stock market updates are not predictions. They describe what is happening now and why it is happening. Understanding this difference helps investors use updates wisely instead of expecting guaranteed outcomes.

Why is Stock Market Updates Important?

Stock market updates are important because they keep investors informed and prepared. Markets respond quickly to news, and updates help explain those reactions in real time.

One key reason stock market updates matter is decision support. Investors rely on them to decide whether to buy, hold, or sell stocks. Without updates, decisions would be based on guesswork instead of facts.

Updates also help manage risk. When markets show high volatility, updates warn investors about uncertainty. This allows people to adjust strategies, reduce exposure, or stay patient during unstable periods.

Another reason is awareness. Stock market updates connect the economy to personal finance. When interest rates rise or inflation data changes, updates explain how these factors influence stocks. This builds financial awareness and confidence.

For long-term investors, updates provide context rather than direction. They help explain short-term movements without forcing unnecessary changes. For short-term traders, updates highlight opportunities and risks quickly.

Overall, stock market updates act as a bridge between complex financial systems and everyday investors. They turn raw data into understandable information that supports better financial choices.

Detailed Step-by-Step Guide

Step 1: Identify the Market Session

The first step in reading stock market updates is knowing the market session. Markets behave differently before opening, during trading hours, and after closing.

Morning updates often reflect overnight global activity and early sentiment. Midday updates focus on volume and trend strength. Closing updates summarize the full trading day and key drivers.

Understanding the session helps you interpret movements correctly and avoid confusion.

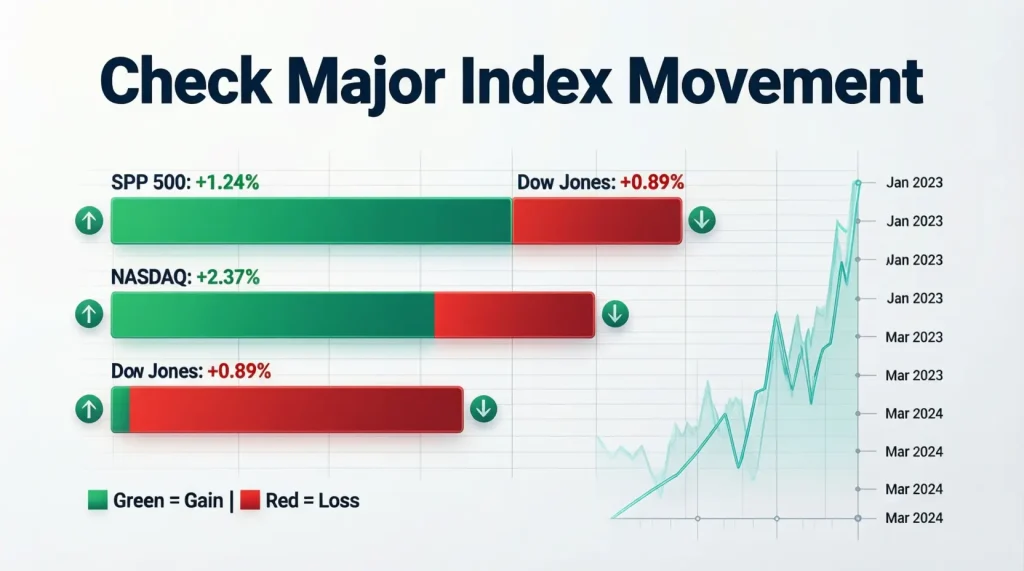

Step 2: Check Major Index Movement

Next, look at how major indexes are performing. Index movement shows overall market direction.

If indexes are rising, it usually means broad optimism. If they are falling, it may indicate fear or uncertainty. Flat movement suggests indecision or balance between buyers and sellers.

This step provides a quick market overview before focusing on individual stocks.

Step 3: Review Sector Performance

Stock market updates often highlight sector trends. Some sectors perform well while others lag.

For example, technology may rise while energy falls. These shifts often reflect economic conditions or investor preferences.

Sector analysis helps investors understand where money is flowing and which areas may offer opportunities or risks.

Step 4: Analyze Top Gainers and Losers

Another important step is reviewing top gainers and losers. These stocks show strong reactions to news or earnings.

Large gains may signal positive developments, while sharp losses often reflect disappointment or concern.

However, one-day movements do not tell the full story. Always consider context before acting.

Step 5: Read Economic and News Highlights

Stock market updates usually include key economic or news highlights. These may include inflation data, employment reports, or policy announcements.

This information explains why markets moved in a certain direction. It also helps investors understand broader trends beyond individual stocks.

Ignoring this step can lead to incomplete conclusions.

Step 6: Observe Market Sentiment

Market sentiment reflects investor emotions. Updates may describe markets as cautious, optimistic, or volatile.

Sentiment influences short-term movement more than fundamentals. Recognizing sentiment helps investors avoid emotional decisions.

Balanced interpretation is essential at this stage.

Step 7: Compare with Previous Days

Finally, compare today’s update with previous days. One update alone is not enough.

Trends become clearer when viewed over time. This step helps identify patterns instead of reacting to noise.

Consistent comparison improves long-term understanding.

Benefits of Stock Market Updates

- Help investors stay informed about daily market activity

- Provide quick insights into price movements and trends

- Support better investment decisions with current information

- Improve understanding of economic and financial events

- Reduce emotional reactions by offering context

- Save time by summarizing complex data

- Build confidence for beginners and intermediate investors

- Encourage disciplined and informed investing

Disadvantages / Risks

- Can cause overtrading if followed too closely

- Short-term focus may distract from long-term goals

- Misinterpretation can lead to poor decisions

- Market noise may create unnecessary fear or excitement

- Updates do not guarantee future performance

- Heavy reliance may reduce independent analysis

Common Mistakes to Avoid

One common mistake is reacting emotionally to every update. Markets move daily, and not every change requires action. Overreacting often leads to losses.

Another mistake is ignoring context. Stock market updates explain what happened, not what will happen. Treating them as predictions can be harmful.

Some investors focus only on headlines and skip details. This leads to misunderstanding market drivers and trends.

Beginners sometimes compare their results with daily market moves. Investing success should be measured over time, not day by day.

Lastly, relying on a single update source is risky. Balanced understanding comes from consistent learning, not quick reactions.

FAQs

What do stock market updates usually include?

Stock market updates usually include index performance, sector trends, top gainers and losers, and key news. They provide a snapshot of current market conditions.

Are stock market updates useful for beginners?

Yes, stock market updates are very useful for beginners. They help explain market movements in simple terms and build basic financial knowledge over time.

How often should I check stock market updates?

This depends on your strategy. Long-term investors may check daily or weekly, while active traders may follow them more frequently.

Can stock market updates predict future prices?

No, stock market updates do not predict the future. They explain current activity and recent events that influence prices.

Do stock market updates replace research?

No, they should not replace research. Updates support decision-making but should be combined with deeper analysis and planning.

Why do markets react strongly to news in updates?

Markets react to news because investors adjust expectations quickly. Updates explain these reactions and help investors understand market psychology.

Expert Tips & Bonus Points

Focus on understanding trends instead of daily noise. This improves patience and clarity.

Use stock market updates as learning tools, not trading signals. Education reduces costly mistakes.

Keep a journal of market observations. Writing improves pattern recognition over time.

Balance updates with long-term goals. Short-term movement should not derail long-term plans.

Avoid checking updates during emotional stress. Clear thinking leads to better decisions.

Stay consistent. Regular reading builds confidence and market awareness.

Conclusion

Stock market updates are essential tools for anyone interested in investing. They provide clear, timely information about market movements, helping investors understand what is happening and why. For beginners, these updates serve as an introduction to market behavior and financial language. For intermediate investors, they act as confirmation and context for ongoing strategies.

However, stock market updates should be used wisely. They are not predictions or guarantees. Their true value lies in explanation, not instruction. When investors learn to read updates calmly and consistently, they reduce emotional decisions and improve long-term thinking.

By following a structured approach, understanding benefits and risks, and avoiding common mistakes, investors can turn stock market updates into powerful learning resources. Over time, regular exposure builds confidence, discipline, and awareness.

In a world where financial information moves fast, staying informed matters. Stock market updates help bridge the gap between complex markets and everyday investors. When used with patience and purpose, they support smarter decisions and healthier investment habits for the future.